In previous posts, we answered the questions Why Do You Need to Reconcile? and How Do You Reconcile in Quickbooks Online?

In this post, I’m going to give you step-by-step instructions for what to do when your beginning balance is off in Quickbooks Online.

Note: Your beginning balance could be off for a variety of reasons, but if you follow these steps, you will be able to isolate the problem and determine the cause.

Option 1: Manual Check

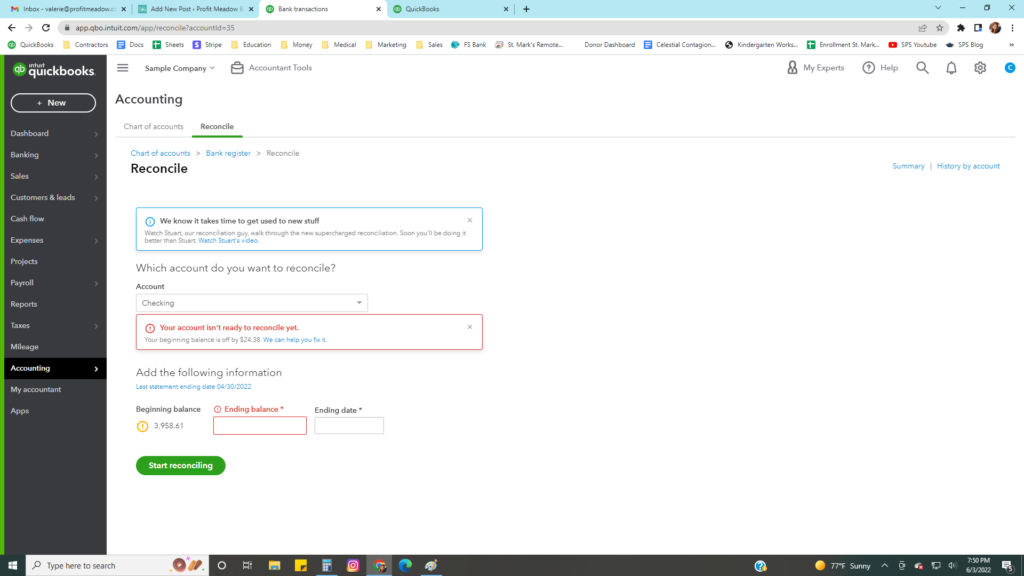

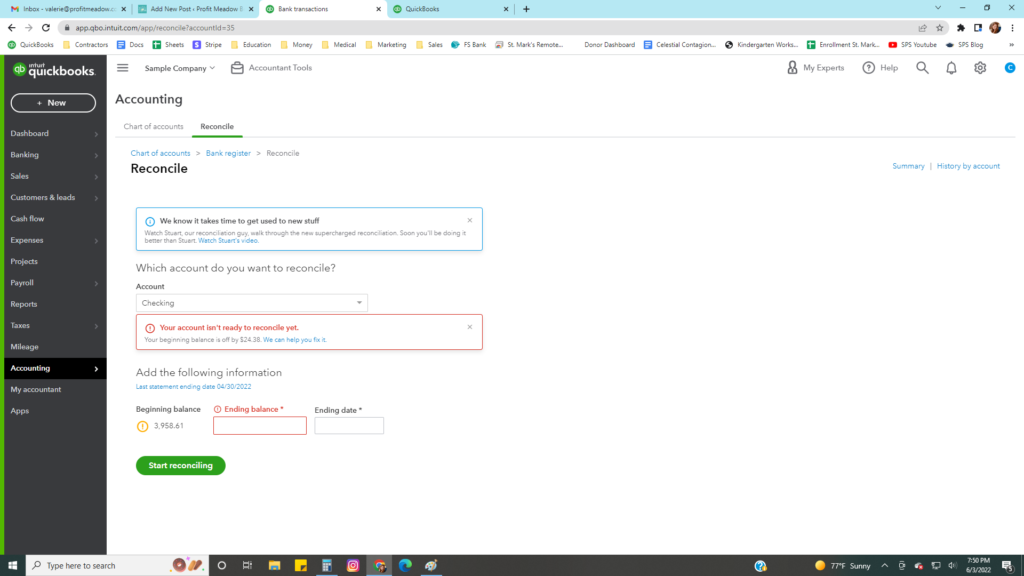

Step 1: You’ve gone to your reconciliation screen and seen this “Your account isn’t ready to reconcile yet.”

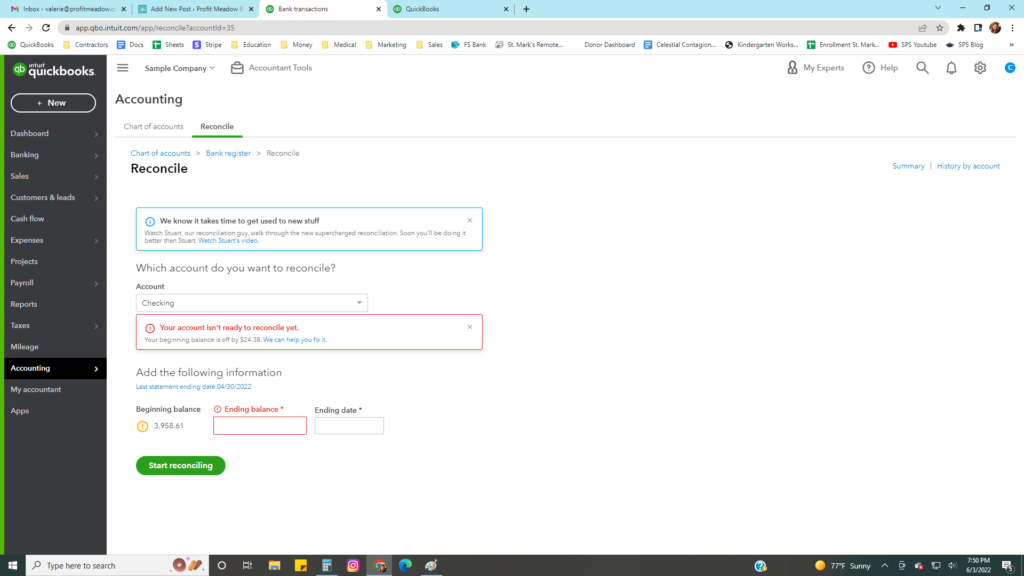

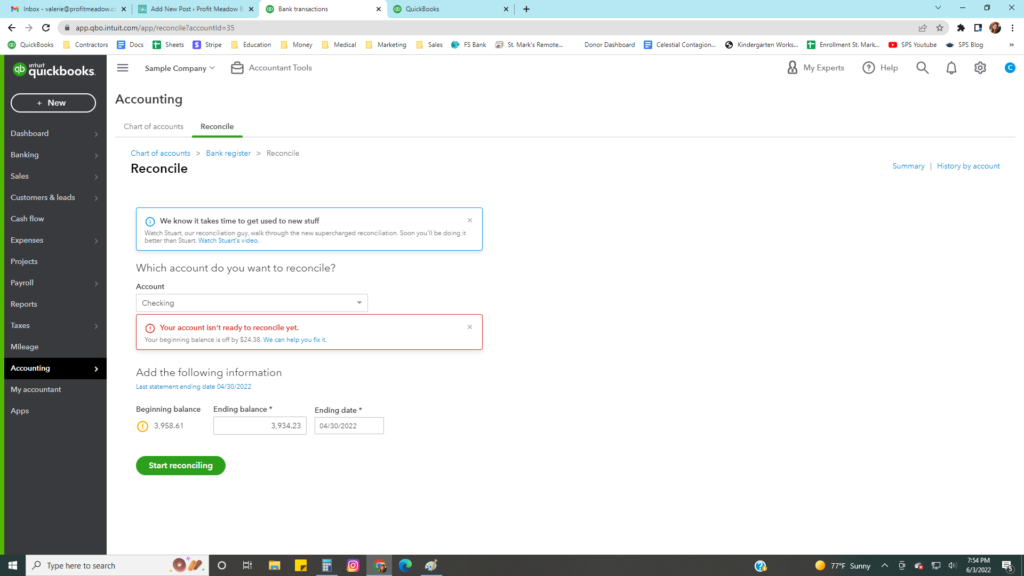

Step 2: Go to your previous bank statement and get the ending balance. For this, it was 3934.23. Set the date to be the same as the date it was last reconciled on. This will only show you the changes in this period-prior periods, and won’t get mixed up with the current reconciliation you were about to start on.

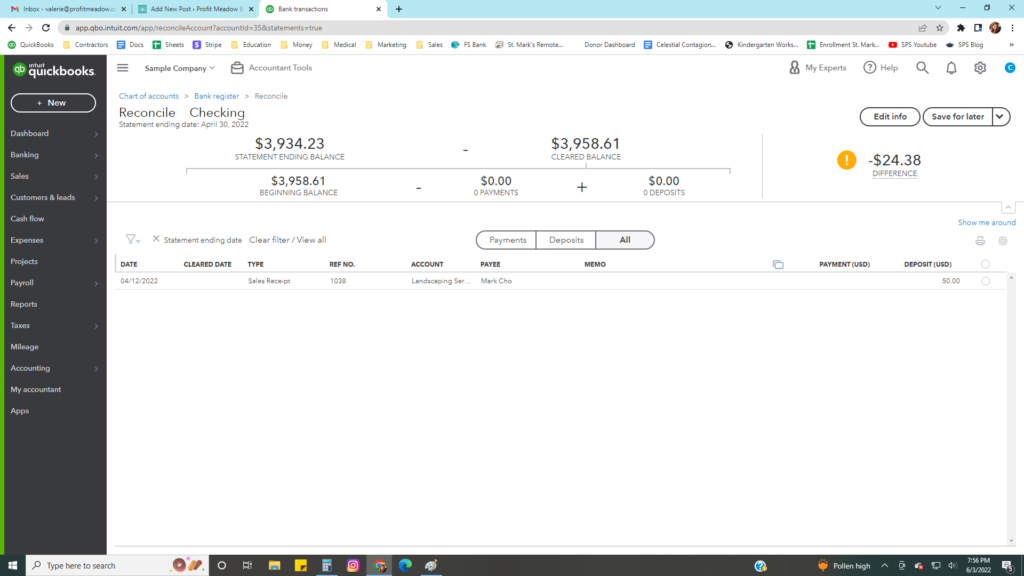

Step 3: View what is different. For this example, the reconciliation is off by 24.38. There is a Sales Receipt that was added on 4/12 that hasn’t cleared the bank, but that doesn’t match the cause of our discrepancy. Since there isn’t anything to choose, we can isolate that something has been deleted in Quickbooks that shouldn’t have been. You can check your statement for the amount to see if it matches anything.

Option 2: History by Account–Reconciliation Change Report

The second option is much easier and gives you a diagnostic report of the differences.

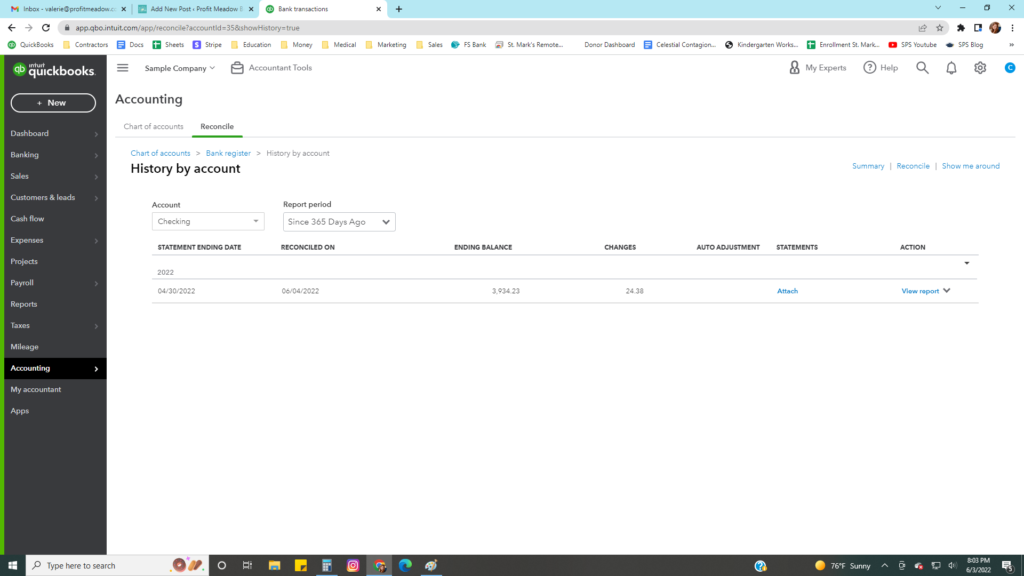

Step 1: Click the blue hyperlinked History by Account in the upper right corner of the initial Reconciliation page.

Step 2: Locate the statement with the change. (There is only one statement in our example, but you should have several in your history.) Click “View Report”

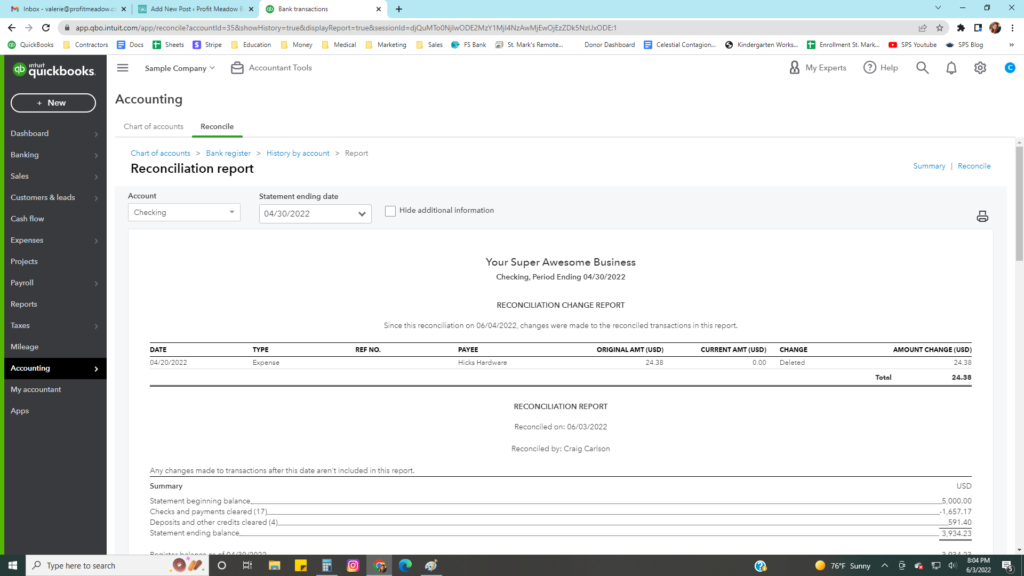

Step 3: The very top of the report has a section called “Reconciliation Change Report”. This not only shows you the amount, but all of the other transaction information as well. We now know exactly what was deleted, and therefore can recreate it.

Want a bookkeeper to do all of this hard stuff for you?

Schedule a FREE Review of Your Books with our team here at Profit Meadow!