Your income statement–or profit and loss statement–is a very important report that you, as a business owner, should pay close attention to. However, it’s difficult to pay close attention to something that you don’t completely understand. Most people can glance at the income statement and get the overall gist of it, but it’s imperative that you understand every small aspect of it in order to run your business in the most effective way possible.

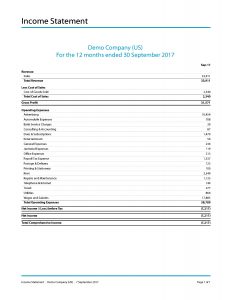

For this post, I pulled an income statement from the Demo Company of Xero. Xero is by far my favorite bookkeeping software, but any software you and your bookkeeper use should be able to give you an income statement similar to this.

Download the example here: Demo Company (US) – Income Statement

The most important thing to know about an income statement is that it only covers a specific period of time, so always make sure that you’re viewing the time period that you want. Xero also gives you the ability to have several columns of numbers from different times periods so that you can compare months, years, etc. The time period should be clearly marked at the top (this one covers a year, ending on Sept. 30th 2017.)

Revenue and Cost of Sales

The first section is the Revenue section, which includes all the money you bring in from sales. If you choose, you can have different categories of sales listed under this heading, like local sales vs. internet sales, so you know how well your business is doing through different channels. The total revenue for this Demo company is $33,911.

You might be thinking, “Wow, that’s a lot of money to make in a year!” However, that money doesn’t go into the business owner’s pocket. The next section is the Less Cost of Sales section, which takes away the cost of making what you sell. If you’re a product-based company that sells clothing, then this would be the cost of your fabric. If you’re a service-based company, like a painter, then this is the cost of your rollers and brushes. This follows the basic notion that you have to spend money to make money. This Demo Company only had $2,340 in the Cost of Sales, which is relatively low, bringing their Gross Profit to $31,571… but we aren’t done yet.

Expenses

The next section is the Operating Expenses. This includes some things that are absolutely necessary for your business, such as Rent, Telephone, and Internet, and some that could be trimmed if need be, like Advertising and Entertainment. This Demo Company spent $10,454 in Advertising alone. Some advertising is necessary to get the word out, but they might need to look into cheaper alternatives in the future. The total Operating Expenses for this company was $38,789. If you remember, they only had $31,571 in Gross Profit, bringing their Net Income to ($7,217). When numbers are in parentheses, it means that they are negative, meaning that this company took a loss in the past year.

Experiencing a Loss

Is a loss always a bad thing, though? It really depends on what’s going on in the business. If the business is a startup, they might need to take a loss in order to advertise more so that they can do better down the road. Also, it makes a difference if the business owner is still able to pay themselves even with a loss.

A loss can be a very bad thing, though. It could be a sign that things need to change. What’s worse is when your business is in a period of loss and you don’t know about it. You should always be aware of the financial health of your business. Having everything laid out in front of you like this report might help you see where you’re spending money that you could cut back on. You might see some expenses that are high, such as internet, and be able to negotiate a better cost with a different provider. Or maybe your Less Cost of Sales section is high and you want to look into switching vendors? If you didn’t know you were in trouble, you wouldn’t think about shopping around and coast along with things as they are.

I hope this knowledge can help you better understand the income statement for your business. (You can find out how much equity you have in your business here.)

Get a FREE Review of Your Books!

Blessings,

Valerie Johnston

Profit Meadow Bookkeeping LLC

Thanks for this article. I’d personally also like to express that it can often be hard when you find yourself in school and starting out to create a long credit rating. There are many learners who are simply trying to survive and have a protracted or good credit history can often be a difficult issue to have.